If you’re a financial services marketer – and particularly if you’re a student of personalized data-driven marketing strategies – you should know that the research teams at McKinsey and Accenture offer two statistics that seem to contradict each other:

- According to McKinsey, 72% of consumers expect the businesses they buy from to recognize them as individuals and to know their interests.

- According to Accenture, 79% of consumers consider their financial institution to be “transactional” and don’t see it as relational.

The 3 Keys to Customer Acquisition, Loyalty and Retention

Personalization is about much more than greeting a customer by name on a piece of direct mail. Thanks to artificial intelligence (AI), third-party data sources and modern data analytics techniques, it’s possible to hyper-personalize marketing communications a variety of ways. In fact, for any given group of financial services customers, personalized data-driven marketing allows you to:

- Use different creative and designs for one customer versus another.

- Offer different products, pricing or features to those customers.

- Reach customers at different times and through different channels, depending on their behavior or known preferences.

Of course, doing this effectively requires a marketing strategy that is backed by sophisticated data analytics techniques. There are three keys to making that happen.

1 - Utilize data analytics to create detailed customer profiles

The first step in any data-driven customer marketing strategy is to start with the data you already have. Fortunately, financial services companies are sitting on a gold mine of data including:

- Account open and close dates

- Account balance history

- Account interest rates

- Spending and saving habits

- Borrowing behaviors, and much more

From this data, you can create a highly detailed customer profile that speaks to each customer’s behaviors, preferences, life stage and current financial services needs. The best thing about this type of “first-party” data is that it’s yours. You own it, it’s free and you can have complete confidence in its accuracy.

2 - Augment your customer profiles with other data sources

There are additional “third-party” data sources available that enable you to paint an even more detailed picture about each financial services customer. By incorporating these data sources into your analytics, it’s also possible to know:

- Which customers are actively in-market for financial services.

- Which product they likely need now – and will need next.

- How best to win them back down the road if they should leave.

Augmenting your first-party data with these external insights will allow you to create data-driven marketing campaigns that engage with the customer on a deeper level and elicit the response you are seeking.

3 - Use data to reach customers when they are most likely to act

In marketing as in life, timing is everything. This is especially true of the financial services industry. Getting married, having a child and buying a home are examples of major milestones in many people’s lives. They also trigger purchases of financial services products relevant to each milestone.

Here again, third-party data sources hold the key. Using various forms of predictive analytics, it’s possible to isolate consumers who are actively shopping for specific types of financial services products online, or who are exhibiting certain behaviors that indicate “purchase intent.” Add these insights to your own customer profile and you have the three key components of a high-performing data-driven marketing campaign for financial services:

- Who you want to target

- What products they need – and why

- When they are most likely to act on that need

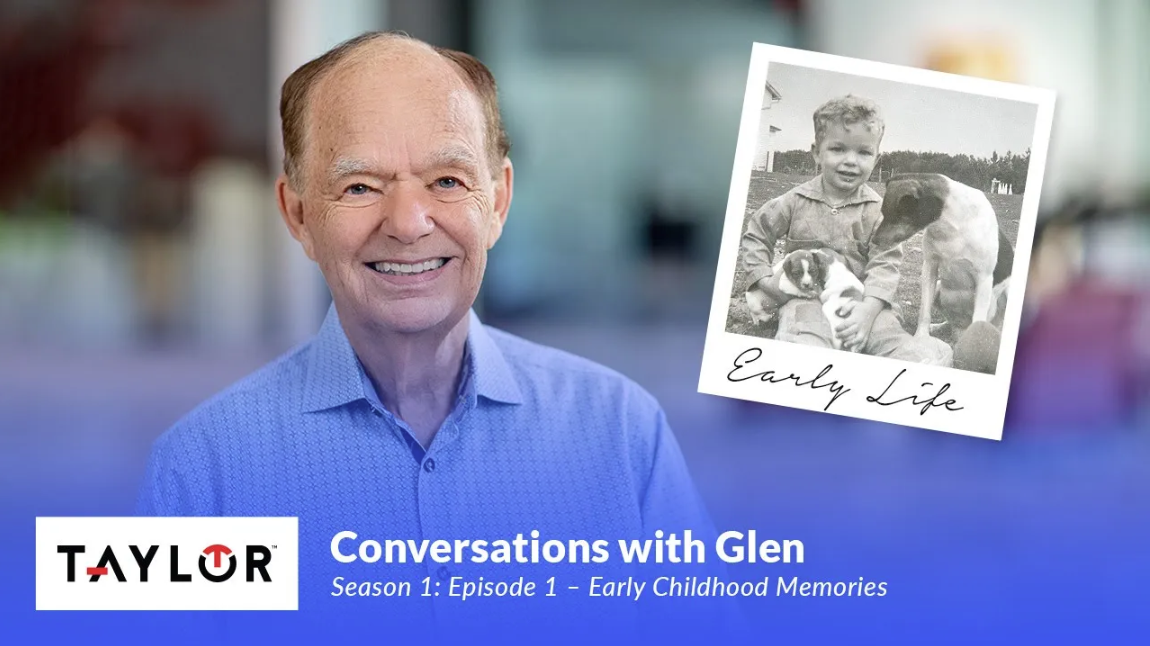

Taylor: A Leader in Data-Driven Marketing Strategies

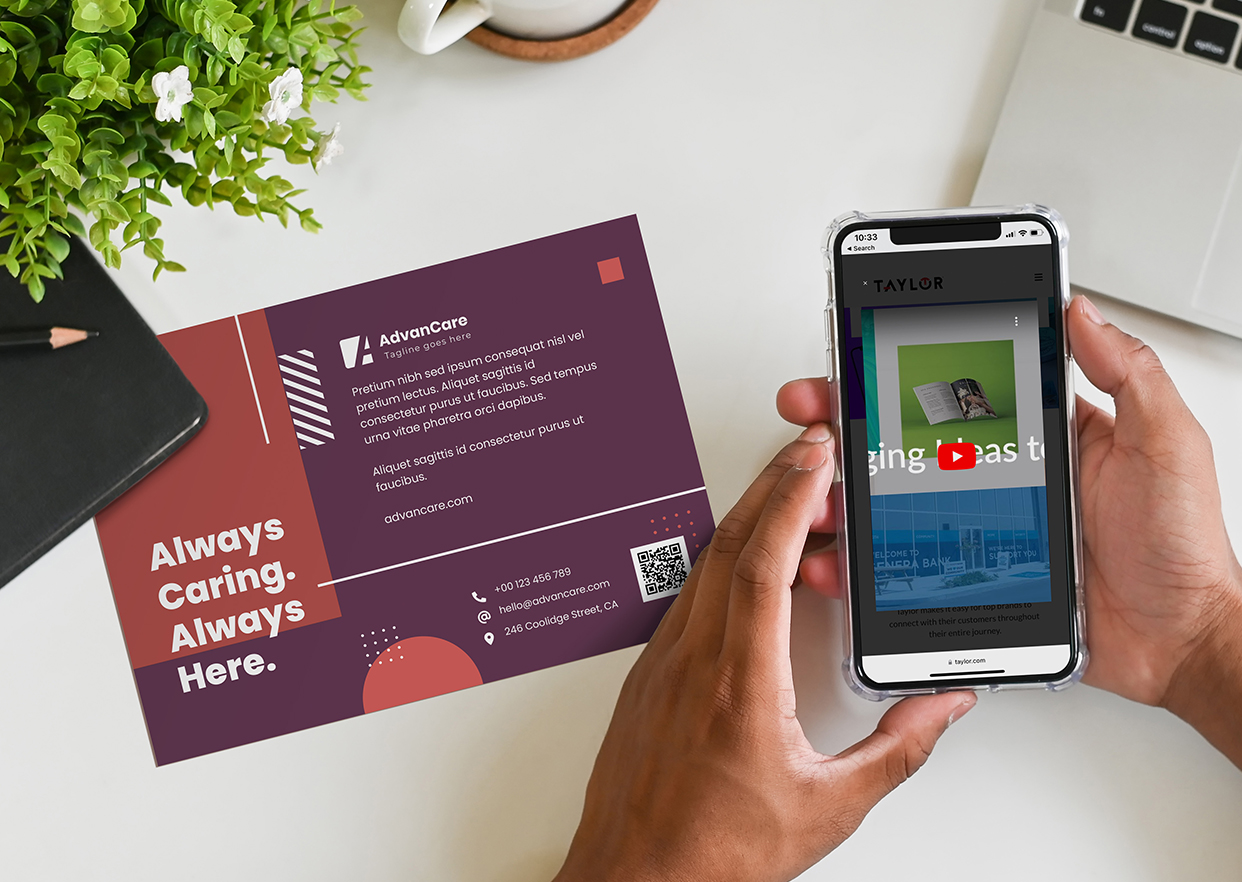

Taylor is a leading provider of personalized data-driven marketing campaigns that are engineered to grab attention and drive results. Retail banks, credit unions, brokerage firms and insurance companies are among the top candidates for these types of services. One solution, in particular, is proven to be highly effective for financial services marketing: The Taylor Marketing Advantage Program.

The Marketing Advantage Program leverages the data described above to maximize the impact of our customers’ marketing outreach efforts. The use cases for the Marketing Advantage Program are as diverse as the financial services industry itself:

New Customer Acquisition

Reach and convert customers actively shopping for your products and services online.

Purchase Intent Triggers

Use geotargeting, purchasing triggers, demographics and sophisticated analytics techniques to find the customers most likely to purchase your products and services.

New Mover

Deploy proprietary data intelligence to reach new movers 2-3 weeks sooner than other new mover sources.

Direct Competitor

Put your brand in front of your competitors’ customers by actively targeting those known to be shopping your competition online or in-store.

Want to lower your customer acquisition costs and increase the ROI on your marketing programs? It’s time employ the latest data science techniques and take a closer look at how you’re using your data. Contact the Marketing, Data & Analytics team at Taylor to learn more about the Marketing Advantage Program.